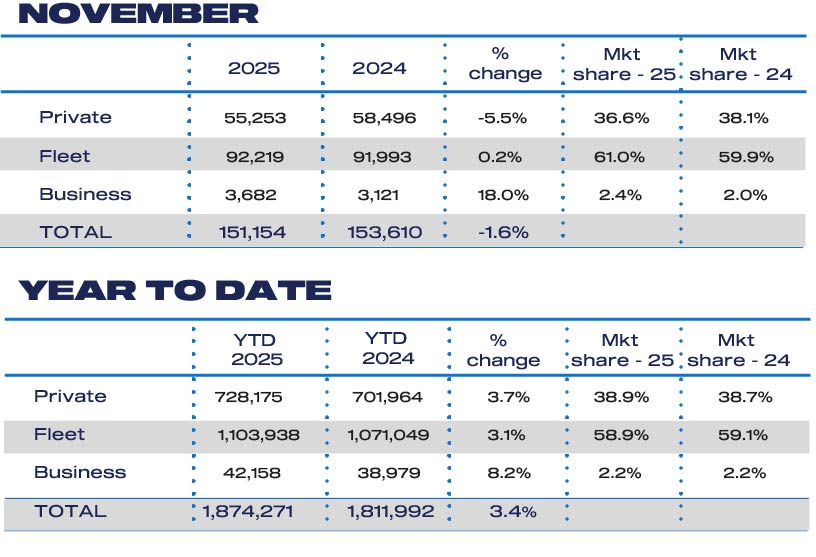

New car registrations were down by about 2% in November, with private sales down 5.5% and fleet registrations flat compared to the same month last year.

According to data published by the Society of Motor Manufacturers and Traders (SMMT), about 2,500 fewer vehicles were registered in November 2025 than in the same month in 2024. In reality, this is more or less the same sort of number that we’ve seen in November going back to the middle of last decade, excluding the ‘Covid years’ of 2020 to 2022.

EVs and plug-in hybrids outperform the market

Although the headline numbers were flat, the make-up of cars sold continues to shift from purely fossil-fuelled vehicles to EVs and hybrids.

Petrol-powered car sales fell by 6%, while diesel cars have become little more than a footnote in new car data. Petrol cars are still comfortably the largest type of new car sold, but their market share fell from 46% to 44%. Electric cars made up 26% of the market, growing by 4% compared to last year, while plug-in hybrids continued their strong growth over the last 12 months and regular hybrids also grew slightly.

Officially, a market share of 25% in November, and 23% year-to-date, means that EV sales are still behind the government’s mandated target of 28% for this year. However, by the time that various loopholes and provisions are taken into consideration, the net target is estimated to be about 23%, so the industry is now on track to hit that by the end of the year.

The targets go up to 33% next year, so car manufacturers will have no interest in over-achieving this year. Most of them are already managing their inventories for the rest of the year to ensure they hit their 2025 targets and carry over any extras into January.

Good month, bad month

Despite overall registration numbers being similar to those of last year, there was considerable movement among the different car manufacturers.

It was a good month for Alfa Romeo, Alpine, BYD, Cupra, Ford, GWM, KGM, Omoda, Polestar, Renault, Smart, Subaru and Suzuki. All of these brands outperformed the overall market by at least 10%.

Meanwhile, numbers were down at Abarth, Bentley, BMW, Dacia, DS Automobiles, Fiat, Honda, Ineos, Jeep, Lexus, Maserati, Mercedes-Benz, MG, Mini, Nissan, Peugeot, Porsche, and Tesla.

That means that the following manufacturers were about where you’d expect them to be: Audi, Citroën, Genesis, Hyundai, Kia, Land Rover, Mazda, SEAT, Skoda, Smart, Toyota, Vauxhall, Volkswagen and Volvo – all of whom were +/-10% on the same month last year.

As usual, Volkswagen was comfortably the best-selling brand in the UK in November, accounting of 8% of all new car registrations last month.

The two big Chinese manufacturers, BYD and Chery Group (Chery, Jaecoo, Omoda), continue to make strong inroads into the market, putting ever-increasing pressure on struggling European and Japanese brands. It’s almost certain that 2026 will see this pressure reach breaking point for some brands within the industry, as there is still plenty more growth to come from the current batch of Chinese brands and others on the way.

Ford Puma edges closer to retaining sales crown

The Ford Puma was again the UK’s best-selling car in November, outselling the Kia Sportage – its main rival in the 2025 sales race – by about 1,000 units. That gives the Puma a formidable lead with just one month to go, although we have seen large swings in the last couple of months in recent years so Ford won’t be celebrating just yet (and Kia has an updated Sportage now in showrooms).

UK manufacturing enjoyed three cars in the top ten, courtesy of the Mini Cooper, Nissan Juke and Nissan Qashqai. The Jaecoo 7 remained in the best-sellers list for a fourth month. The make-up of the top ten could shift dramatically for 2026, as the UK government makes significant changes to the makes and models of cars available via Motability, which accounts for about 20% of all new car registrations.