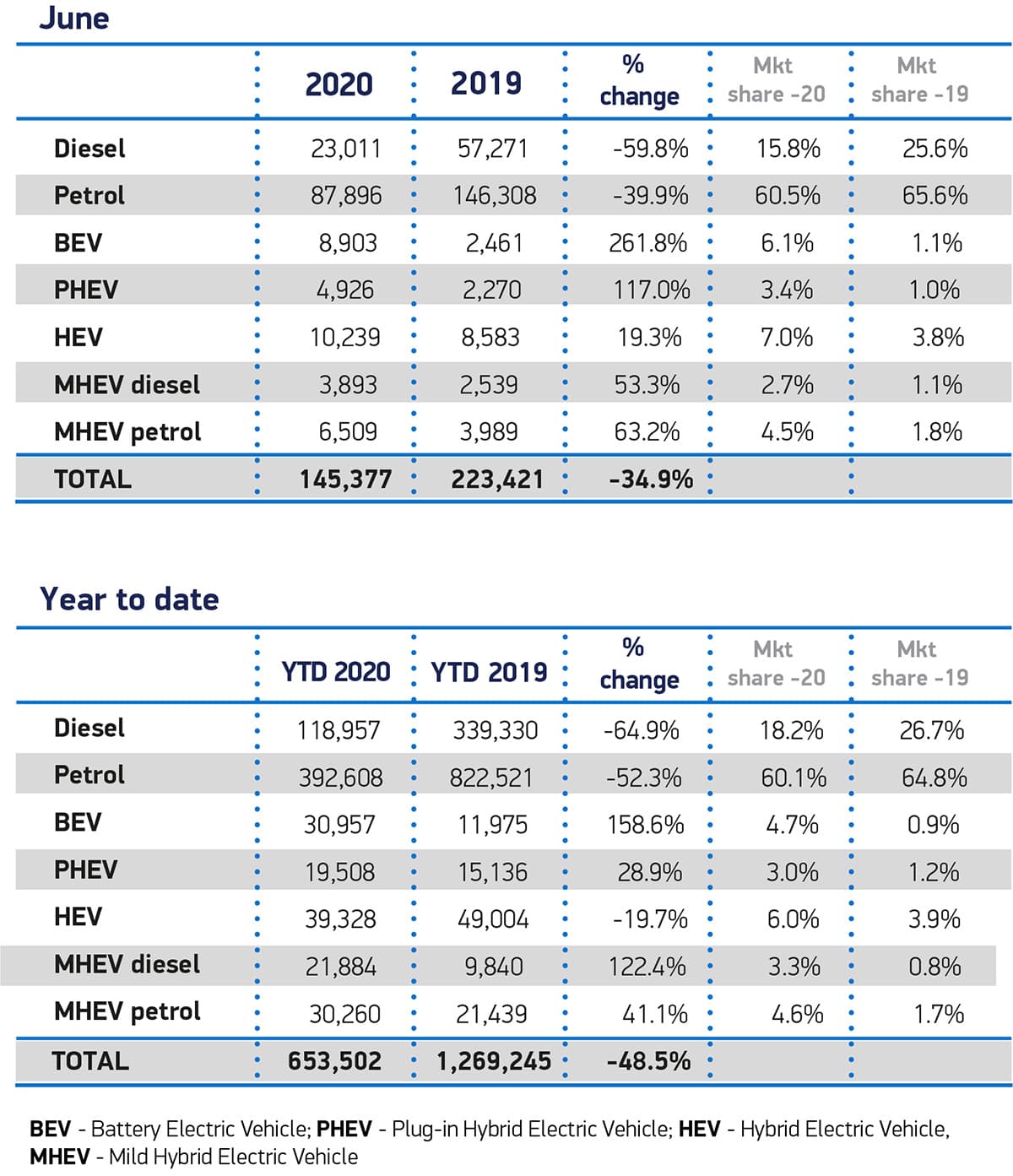

New car registrations in June showed a reasonable amount of recovery from the disastrous figures for April and May. According to figures published this morning by the Society of Motor Manufacturers and Traders (SMMT), overall new car registrations were down 35% compared to the same month last year, although there are plenty of caveates to those results.

Private new car sales led the way in June as consumers began returning to car showrooms, with sales down 19% compared to June 2019. In England, doors opened right from the start of the month – although the SMMT estimates that 20% of dealers remained closed – while in Wales the date to reopen was 22 June and Scottish dealers could only open on 29 June.

What is not clear is what percentage of these numbers were collections of vehicles ordered before lockdown, and how many were fresh sales once dealers re-opened. The industry is not expecting great things over coming months, with the SMMT setting out its case for government support ahead of an expected call for a new scrappage scheme.

Fleet and business registrations were far more subdued, down 45% and 53% respectively. This is not surprising, with many companies still closed or fighting to keep expenditure to an absolute minimum. Until employees start returning to their workplaces rather than operating from home, there is no great urgency to provide them with new company cars.

Diesel sales slumped to even lower levels in June at about 18% of the overall market (including mild-hybrid diesels), hurt even more by poor fleet registrations and a strong month for small cars, which are often not evan available with diesel options. This fall has come directly at the expense of of electrified vehicles, with hybrid/plug-in hybrid and full-electric cars taking a record 16.5% of all registrations in June.

Year-to-date picture shows scale of collapse

With the first half of the year now behind us, the scale of the hit that the car industry has taken is illustrated quite starkly. For the first six months of 2020, overall new car registrations are down by more than 48%, with fleet and business sales again performing worse than private sales.

Electrified cars have taken nearly 15% of all registrations so far this year, with full-electric cars showing the greatest growth. Petrol-powered cars have seen a slight loss in market share but still command 65% of the overall market. Diesel cars, unsurprisingly, have taken the biggest hit with sales down nearly two-thirds over the first half of this year compared to the same period last year.

Good month, bad month, ugly month

For most car manufacturers, June was another month of bad news. With the overall market down by nearly half, there wasn’t a great deal to cheer about – unless you happen to work for MG or SsangYong, that is. The two budget brands both had very strong months, with MG almost doubling its sales compared to June last year (and almost tripling its market share). SsangYong recorded a registration increase of 30% compared to June 2019, which also more than doubled its share of the total market.

The success of these two budget brands suggests that new car buyers are reining in their spending in the light of economic uncertainty, and harks back to a decade ago when then-budget brands Kia and Hyundai did similarly well in the wake of the banking crash of 2008. Incidentally, those calling for another government-sponsored scrappage scheme may do well to remember that budget brands did well last time it happened – at the direct expense of volume brands and UK-built cars…

It was also a good month for hybrid-focused brands Lexus (up 13%) and Toyota (up 3%) and not-exactly-a-budget-brand Bentley, which was up more than 8%.

On the other side of the ledger, it wasn’t a great re-opening for DS Automobiles, Honda, Hyundai, Mazda or Suzuki, all of whom saw registrations fall to a greater degree than the overall market. Some of that may be dependent on supply levels, so we’ll keep an eye on it in coming months.

Life was even worse for Smart, not looking too clever with a fall of 72% against a market down 48%. But taking the wooden spoon for June was Subaru, which saw an 82% fall for June and only registered 44 cars for the entire month. If that doesn’t improve in short order, we may be saying sayonara to Subaru in the UK altogether.

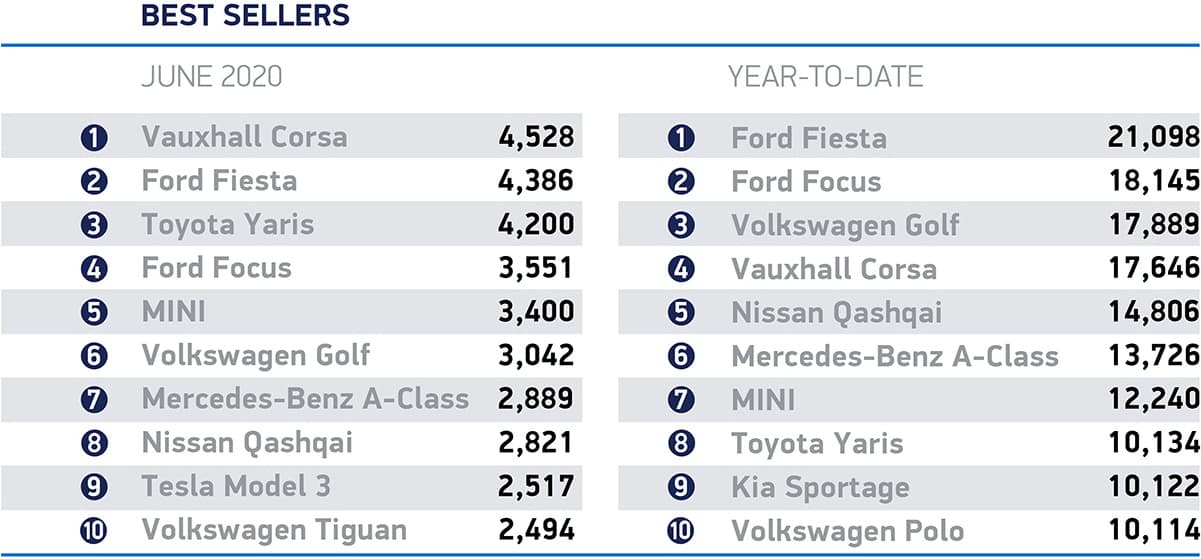

Corsa cleans up as small cars dominate sales

With a lot of economic uncertaintly about, and fleet registrations still very depressed, it’s probably not surprising that the new car market for June was dominated by small car sales. The new Vauxhall Corsa topped the table over the Ford Fiesta, with the nearly-departed Toyota Yaris in third place.

It was also a good month for the Ford Focus, in fourth place for June and overtaking its nemesis, the Volkswagen Golf, in year-to-date sales. The Mini hatch was the top-selling British-built car for the month, with the Nissan Qashqai also reappearing to restore some local honour after May where no UK-built cars made it into the best-sellers list.

Tesla sold three times as many Model 3s in June as it did in May, but it still slipped from first to ninth place, just ahead of the Volkswagen Tiguan, which popped up in the top ten list for the first time in a while.

We’ll have are usual analysis of the top ten in coming days as usual.